The Mineral Exploration Company Model

Mark Sonter

The ‘Professional Mining Exploration Company Business Model’: A ‘pipeline’ of projects.

(and its application to asteroid mining)

Long term mineral exploration survivor companies (the successful ‘junior explorers’) all work a bit like this

- generate via desktop studies, including reviews of the open literature, and development of orebody models, *multiple targets for exploration*, in their specific geological and commodity-market areas of expertise

- carry out further minimum-cost studies to reduce the field by winnowing the targets which seem least worthy of further studies, which studies may be satellite hyperspectral or aerial magnetic or other cheap broad-area remote sensing (the ‘fails’ go into a ‘look at these later’ basket).

- Somewhere about here in the process, the company needs to obtain an ‘exclusive right to explore’, an exploration licence, that hopefully carries an explicit right to roll over if successful to a ‘right to mine’. Note this right or concession in many jurisdictions, including eg Australian states, does not confer ownership of the land or even the contained minerals, which remain owned by ‘The Crown’, ie, the government. In fact, all that gets conferred is a right of access for purposes of mining, and ownership of the extracted values, with royalties payable based on value extracted.

- After gaining right to access, perform minimum-cost first field studies, which may be aerial remote sensing, stream sampling, or surface geophysical; these studies are intended to de-risk further investigations by continuing the selective rejection of ‘poor performer’ targets.

- Finally you start to get serious (and begin to think about spending big money): the surviving prospects begin to get looked at as potential projects: what size resource will be needed to support what size operation? What notional capex to develop? etc–with these thoughts in mind, the Board may decide to go shopping for Joint Venture (JV) partners:

- With general ideas of potential project size in mind (remember, this is still well before any clear proof of mineralization, much less ore), the proposal gets put out to potential mining house ‘majors’, or ‘mid-tiers’, especially those known to be ‘on the acquisition trail’, for an agreement to buy in (or farm-in): to take up some agreed level of equity in the proposed project in return for ‘funding through to completion of green fields reconnaissance drilling program’ (for example); and if successful, then further funding for ‘further drilling to completion of maiden JORC Inferred Mineral Resource Statement’, earning a further agreed equity tranche.

- If the numbers are still positive, then a further level of financial support might become available from your JV partner, which might be ‘funding through completion of Pre Feasibility Study (PFS)’,earning a further tranche of equity.

- By the time a project has made it through to completion of Final Feasibility Study, the exploration company / operator will have traded away probably 80% or 90% of its equity in the project to the JV ‘major’, but will have gained a project which has been almost completely de-risked, and which is by this stage well defined in both a technical and financial sense. And vastly more valuable than it was when still just a desktop prospect.

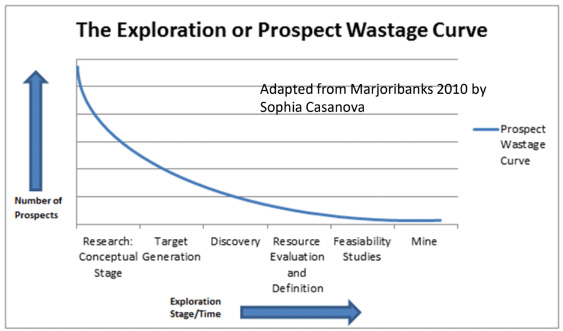

Successful explorer companies are good at ‘project generation’, and will have several such projects on the goat any one time, and at various stages of development. Inevitably, and budgeted in, a proportion will drop out due to their prospectivity not living up to initial hopes, at various stages. But the cash flow into the company, to continue its exploration and de-risking activities, comes from the management fees earned on several JVs

The few projects that make it through to confirmation of ore reserves, then completion of metallurgical test work, then prefeasibility study, and final or ‘bankable’ feasibility study, each stage being funded, at increasing levels and with increasing transfer of equity to the ‘major’, ‘gated’ by successful completion of earlier stages, are projects that have grown in certainty, being successively de-risked, and will have also grown in valuation, by multiple orders of magnitude.

So the exploration junior trades off equity, stage by stage, in individual projects against the supply of ongoing funding, on an agreed, gated, basis. But it still wins, because it has had its ongoing operation supported, AND it has retained some equity (but a diminishing proportion) in a project whose book valuation has increased by orders of magnitude. And, for the very few projects that survive the very rigorous sieving of the Final Feasibility Study, and then go into production, the exploration minor still retains a free carried or remnant equity, and now free cashflow. In addition, and desirably, it may or may not, depending on the specifics of the original agreement, retain operatorship, in which case it also retains the cashflow associated with the project management fees.

Note: the exploration company never at any stage trades off any of its own equity, only equity in individual projects. The exploration company thus never loses control over its own destiny, despite the fact that it is in advance with an elephant. It retains the right to deal with multiple different Joint Venturers, on its various other ventures.

Now, why is this relevant to us?

Well, we can, and should, set up asteroid mining proposals in a similar way. The time-limited nature of most asteroid mining ventures literally begs one to do this *anyway*, because you *have to* develop a pipeline of sequential projects. Scheduling of supply demands it, and additionally, commodity payloads enroute on return trajectory represents warehoused, ie bookable, assets.

ARPPS presently has a concept-level ‘pipeline’ of about 8 identified targets for further investigation.