Mining Concepts – Ore and Orebodies

Mining Concepts : ore and orebodies , and lessons for Asteroid Mining

Mining Philosophy

Mineralization: is the presence of (valuable) mineral in sufficient concentration to consider feasibility of mining. Extent and continuity, and consistency of grade, yet to be tested.

Mineral Resource: is the presence of potentially-economic mineral ‘deposit’: questions of extent / tonnage, grade, continuity, and penalty elements not yet determined: however, no consideration of amenability or costs to mine, process, or transport. Classified as ‘Inferred’, ‘Indicated’, or ‘Measured’ Mineral Resource: these are only qualitative statements of level of confidence. Can only be made by a ‘qualified person’.

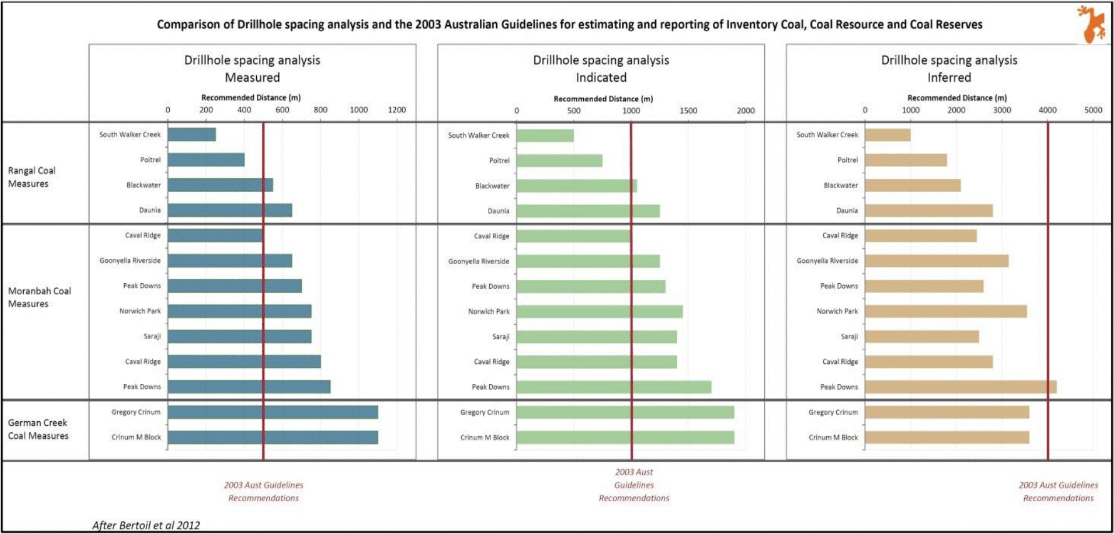

These assessments are classically done as ‘professional judgement’, ie, qualitatively, but based on very extensive drill hole assay data. The drill hole grid spacing depends on the spatial variability to be expected across the mineralization / putative orebody. See below.

There is a slow incursion of quantitative, probabilistic methods into this area, termed ‘Resource Range Analysis’, where one develops a probability distribution (hence ‘range’) of the likelihood of size of resource. This is being used eg by BHP and others to assess sparse data for the sieving (down select) of proposed new greenfield projects which are in internal competition for follow-on exploration (Resource Development or ‘Res Dev’) funding.

Amount and density of data believed generally to be required for estimation of Mineral Resource, depends critically on the extent and variability of the body of mineralization: for example, for Queensland coal fields, see below, where ‘Inferred’ is considered to require something like 4 km grid spacing, ‘Indicated’ needs 1 km, and ‘Measured’ needs 500 m.

Early coal measures were inferred mainly from outcrop observations, in hillsides, sea side cliffs, creek cutting exposures, and rail and road cuttings (not primarily from drill hole data).

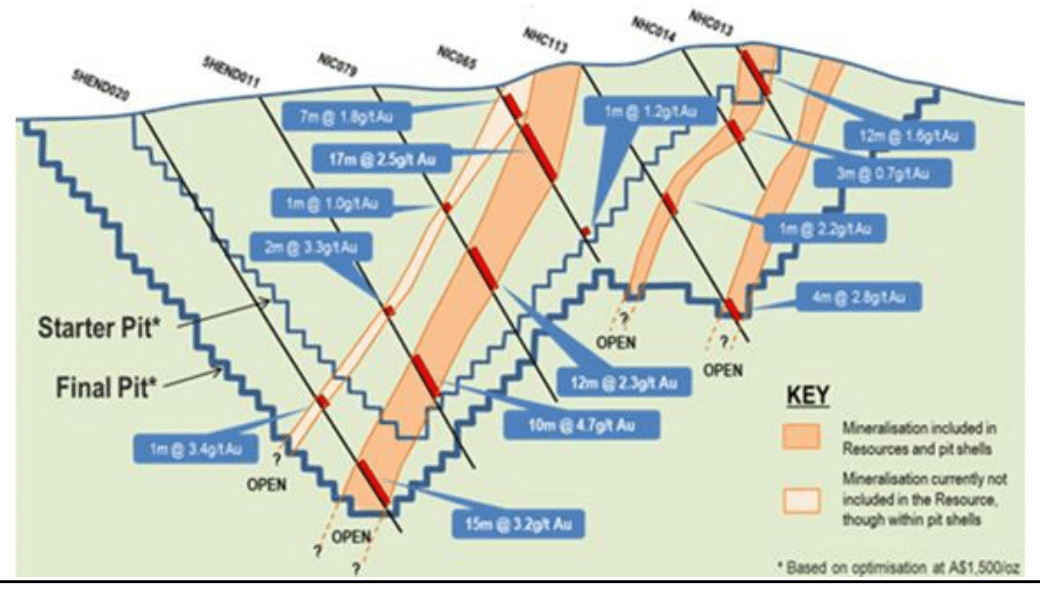

Only after a conceptual mining (and processing) plan has been decided upon, costed, and shown to be probably profitable, can one then call a mineral deposit an ‘ore body’. Only once one has defined an orebody (with ‘proven’ or ‘probable’ grades and tonnes) can one enter it on the company’s books as an asset.

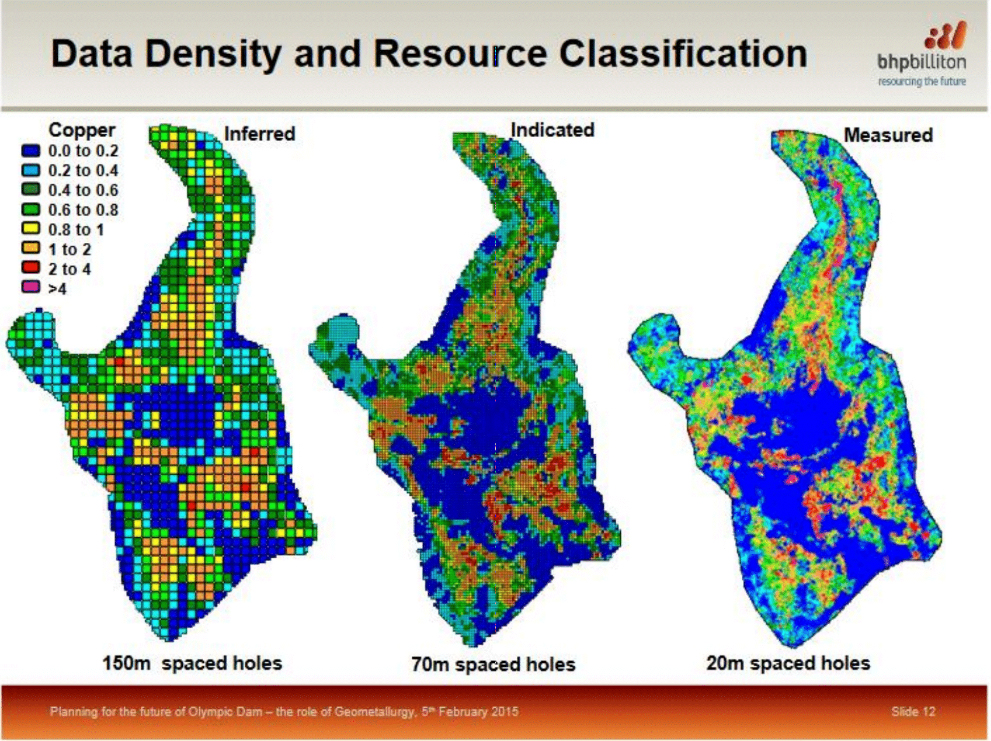

But for hard-rock deposits, with their much smaller scale, and very much larger smaller scale variability, you need much tighter spacing: Here’s what is presently being used at OD

Note; above diagram is only a cartoon: it does not include vertical thickness…

We assert on the basis of John Lewis’s interpretations and our target body models, that asteroids as bodies of mineralization are more likely than not, relatively homogeneous all the way through (except for surface desiccation) and thus much more like coal measures orbauxite deposits, and not at all like hard-rock base-metal mines.

Ore: (‘that which can be mined for profit’)

Ore Reserve: Is an assertion of the size of the ‘orebody’ that can be economically mined and processed and the product transported to market, at a profit: must be based on mining and processing costs, derived via a conceptual mining plan and process flow sheet, costed(eg) via a Preliminary Feasibility Study (PFS) which has sought to identify and quantify various ‘Modifying Factors’, such as mining dilution, and metallurgical recovery. Ore Reserves can be classified as ‘Probable’ or ‘Proven’.

Orebody: It is quite important to have an accurate mental picture of the size, shape, physical properties, and metallurgical properties which define your orebody (or else you might-for example-put your mine in the wrong place, or build the wrong metallurgical treatment plant…) (I have actually seen this strategic-level error play out… duh..)