Synthetic Space Market: Thoughts

The potential markets can be readily identified

- Space-tug boost of new commsats from LEO into Geostationary Transfer Orbit (GTO) and then apogee circularization burn to insert into GEO. This requires a dv total of 3.8 km/s and thus the fuel reqt is approximately equal to the total satellite mass to be inserted. Price point for fuel in LEO might be $1k-3k/kg. ULA, in 2016, sought supply of 100 tpa, at $3k/kg, from 2023, for a defined segment of this market, namely fuel for space tug boost from LEO and circularization into GEO, of an assumed US DOD demand for 3 ‘super-heavy’ spysats per year.)The emerging ‘New Cold War’ between China and the ‘rest of the world’ will quite likely result in a larger in-space fuel demand than this, for spysats and also for ‘satellite-inspector’ spacecraft (see appendix). Assume total ’defence spysat’ boost market is ca 400 tpa, which is only a little above the early ULA stretch target of 300 tpa. Value of market, say $400M-$1200M.For argument’s sake, say $800M.

- LEO fleet separation, altitude maintenance, collision-avoidance, and end-of-life de-orbit. Only a few kg per satellite per yr, but there are plans for many thousands of imagery, comms, internet, IoT, etc sats in LEO over the next 5-10 yrs. Active separation is now critically important therefore all new satellites do need manoeuvre ability. The refuel concept boggles my mind, but it is being addressed, leader being Daniel Faber’s Orbit Fab. Total fuel market, maybe something like 100 tonnes/yr. Predictable price point might be $2k/kg. Assume total value is $200M.

- Fuel and consumable water for commercial space stations (such as are being proposed by Bigelow, Nanoracks, Axiomand others). ISS uses some 100 tpa. So would others, fuel usage proportional to cross-section. Price point: ISS presently pays $10k/kg for water, but a more realistic, conservative figure would be $1k-2k/kg. Say total market might be 200 tpa in LEO. Hence market value is $200M-$400M. Say $300M.

- GEO orbit maintenance, mainly north-south station keeping (NSSK) fuel. This is only a few kg per yr per satellite, but highly valued, as permanent loss of position renders the satellite non-earning, and thus loss of revenue of several million dollars per month. There is already a market to supply permanently-attaching tugs to take over such station keeping duties, for satellites which have depleted their fuel. Another related tug duty will be disposal of old, obsolete geostationary satellites into the ‘graveyard’ orbit some 500 km higher, to ‘clear the slot’ for replacement new tech satellite. Total annual addressable market will be maybe a few (eg 10) tonnes, @ $10k-30k/kg. This implies a total value of $100M-$300M. Say $200M.

- Lunar logistics reqts: these break out into: LEO to Gateway; Gateway to surface; surface to Gateway; Gateway to LEO. Gateway could be at EML2 as presently planned, or could be a dedicated logistics node at EML1. In any case, Gateway/EML1 will be a fuel depot, and the requirement may be in the range 100-200 tpa, following my own, and Dallas Bienhoff’s, ‘first principles’ analyses. Predictable and conservative price point might be $10k-30k/kg. This gives a market value of $1B-$3B. Say $2B.

- Fuel reqt for departing Mars Missions: this fuel reqt will almost certainly be in HEEO (High Elliptical Earth Orbit), so as to have the departing spacecraft already in high energy orbit, and to take fullest possible advantage of Oberth Effect during perigee passage departure burn. Musk’s Star ship has a full refuel reqt of something like 1100 tonnes being 800 t of LOX and 300 t of methane. He can either haul it all up from Earth, or buy from a third party and eliminate or reduce his tanker fleet surge launch demand . The Mars Colonization Fleet size which Musk envisages is massive: 1000 ships departing each synodic period. Even if his own costs to HEEO are only (say) $50/kg, he will still have pressure on him to buy from extraterrestrial sources due to fleet number and earth side launch cadence constraints. A reasonable price point would be (say) $100/kg. Assume in early years, a departing fleet of 100 ships every 26 month synodic period, ie equivalent to 50per year. Propellant load is 1100 tonnes, so this means 55,000 tonnes. At $100/kg, this means ca $5B. Total of all above is $8.5B.

Despite the withdrawal of ULA’s Request for Proposal, nevertheless, the assessment of market need presumably remains relevant, ie 100 to 300 tpa, solely for boost of US DoD spy sats to GEO. Recent geopolitical events suggest we ‘up’ this ‘defence’ demand, and above I have suggested 400 tpa. A maturing commercial GTO boost and circularization market would probably be in the range of something well above 500 tpa.

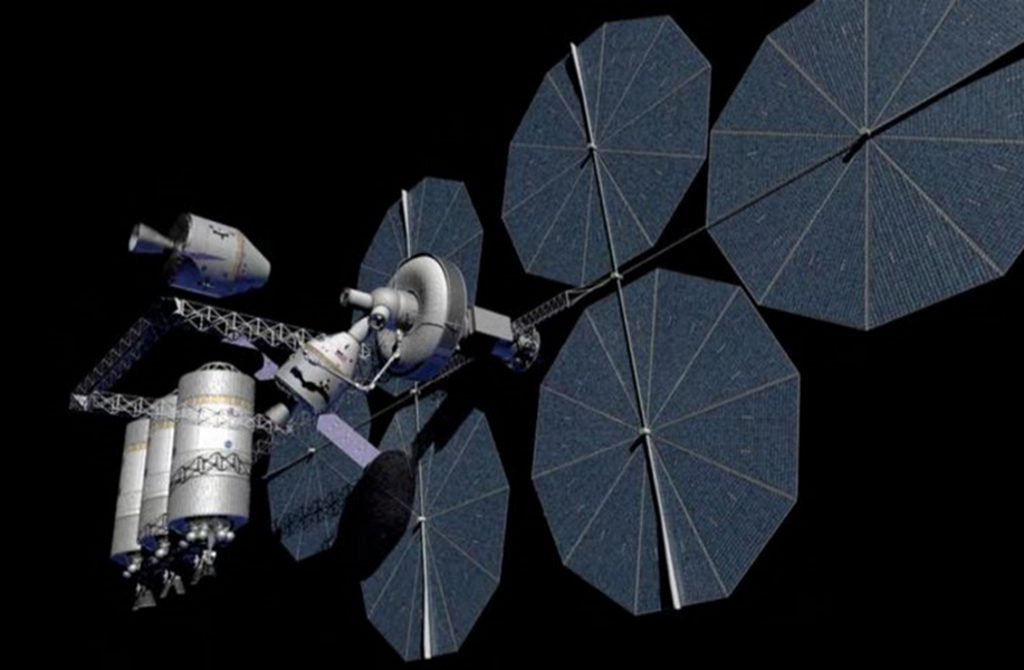

Dallas Bienhoff has been thinking about the potential market for his Cislunar Space Development Corp (CSDC) proposed Space Tugs, to be used for GTO / circularization boost, and for lunar logistics.

Bienhoff predicts propellant requirements in LEO ranging from low estimates around 20 tpa to high estimate ca 500 tpa, and requirements in EML1 at 50 to 200 tpa, depending of course on ramp-up of lunar activities, and assuming mass delivered to lunar surface between 25 and 100 tpa. These demands represent a market between $3B (low side) and $12B (upside) per year.’

Regardless of just who runs the logistics for to-lunar-surface and return to Gateway, and Gateway back to Earth (CSDC or other), the demand will be presumably ‘in the range’ given, namely 50 to 200 tpa fuel at Gateway.

Other sources for estimates of demand are :

- ‘Commercial Lunar Propellant Architecture’ by the Denver/ULA Study group, Kornuta et al (2018)

- Space Mineral Resources’ ed Art Dula & Zhang Zhenjun, IAA, 2015

- Study by Jeff Plate, of Watts, Griffis & McOuat, 2019 (WGM a well-known Canadian geo logical consultancy), and follow-on new start by Boucher & Plate titled ‘Interstellar Mining’.

- Blair, Baiden, & Sowers, in their new ‘Moonrise Resources’ lunar mining venture, referencing all the above, propose figures for LEO propellant depots, GEO customers, and EML1 depot, of 600, 250, and 200 tpa respectively.