The Message for the big Resources Companies

The Message for the big Resources Companies

(and don’t forget the Oil/Gas majors, and don’t forget the big Japanese ‘Commodity’ entities..)

I have been wondering about how to get the attention of the right people in companies like Rio and BHP and others (include groups like Barrick, Newcrest, etc.)

And the big oil majors like BP and Shell.

And the big trading houses–Mitsubishi, Sojitz, Marubeni etc

And how to get past the superficial and frankly juvenile pitches which I am pretty sure have already damaged credibility of the concept, and will continue to do so, undisciplined boosterism that just showcases lack of understanding, lack of technical competence..

The top level observations I make are that I think we need to identify with our audiences the following as major causes for concern for all of them.

(i)resources are getting harder to find. Big deposits are not coming down the pipeline. This applies both to hard rock and hydrocarbons. No big new deposits, or at least many fewer than needed.

This has been obvious for maybe a decade or more, at least, and is part of the reason why the big companies have drastically cut their in-house exploration capability. “We no longer know how to explore, so might as well default to acquisition of early stage projects.” But this isn’t working either, because the small expln companies cannot raise money, so there is a lack of early-stage stuff to buy. In any case, the task itself is becoming harder, despite the ever-higher tech being thrown at it, because the ‘low-hanging fruit’ has gone.

But humanity needs stuff, so where we will get it from is an increasingly urgent question.

(ii)having found or purchased some new big project, it is also getting harder and harder to get through the permitting process to operation.

Observe the disgraceful goalposts-shifting exercises that we have seen with Toro’s Wiluna U mine, where the Gillard govt delayed them by an end-of-EIS re-review that caused them ultimately to miss the market; and the more recent fed and state shenanigans to try to stop Adani’s Carmichael Coalmine and with it the entire Galilee Basin development

Politicians and regulatory bureaucrats have everything to lose and nothing to gain by approving some project and thereby drawing the ire of the NIMBY, XR, and BANANA (‘Build Absolutely Nothing Anywhere Near Anything’) objectors. They talk about minimising risk, but the only risk they are thinking about is to their own positioning…

We (the resources industries) are persona non grata with the entire political establishment. Mining is now close to defact to banned in many parts of the world

Yet humanity still needs power (coal and oil) and resources. It’s nuts.

(iii) Big mining / oil & gas / resources companies must always shave on their mind: where and how can we grow? What new commodity area should we get into? What new market is developing where we can plant our flag and grow exponentially? How do we gain a long term, sustainable competitive advantage?

In the past, the answer has been: find a new massive deposit, or preferably, an entire field, and develop it; and / or develop new breakthrough technology and maintain tech lead.

Example of the first best known to us ex-WMC brigade, was Kambalda nickel; and Olympic Dam Cu-U. other major field finds in Australia were Weeks’ discovery of offshore oil in Bass Strait; or Lang Hancock’s discovery of the Hamersley Iron deposits. Going back in time, there were the discoveries of Broken Hill (Pb-Zn) and Mount Isa (Cu-Pb).Examples of break through technologies were Sherritt-Gordon’s nickel process, purchased by WMC for Kwinana, or Outokumpu’s smelter technology

There are lots of others.

Where do the investors go, both little and big, in the resources industries, for sustainable high-growth results?

Thus we see the massive growth in investments in tight-formation gas (fracking, coal-seam gas); and in lithium, graphite, and cobalt; and REEs.(Fracking btw is going to fall over big-time, as it become sever-more obvious that they are money-burners not money-makers.)

BHP cast around for a new, massive-market commodity, and picked potash. Rio has given up on uranium

(iv)what new, presently embryonic, resources ‘play’ is there, which holds promise of exponential growth, which deals in a high-value product, and in which a first-mover would gain extreme knowledge lead over later-comers, such as to confer clear long term sustainable competitive advantage?

(v)what can we get into that ‘fits the zeitgeist’?–you know, green, renewable, sustainable, non-impactful, cuddly… none of this dirty ‘despoil the environment’ mining or fracking. In other words, the new commodities / markets growth areas need to be something that will not raise the kneejerkire of the political class and self-identifying ‘socially-responsible’ populace. (if you detect a degree of antagonism in these words then yeah..)

So, whatever this new commodity/market is, it has to be self-evidently a part of a jigsaw that is set to deliver asocial good, and more obviously so than the now-scorned historical mining and oil & gas industries.

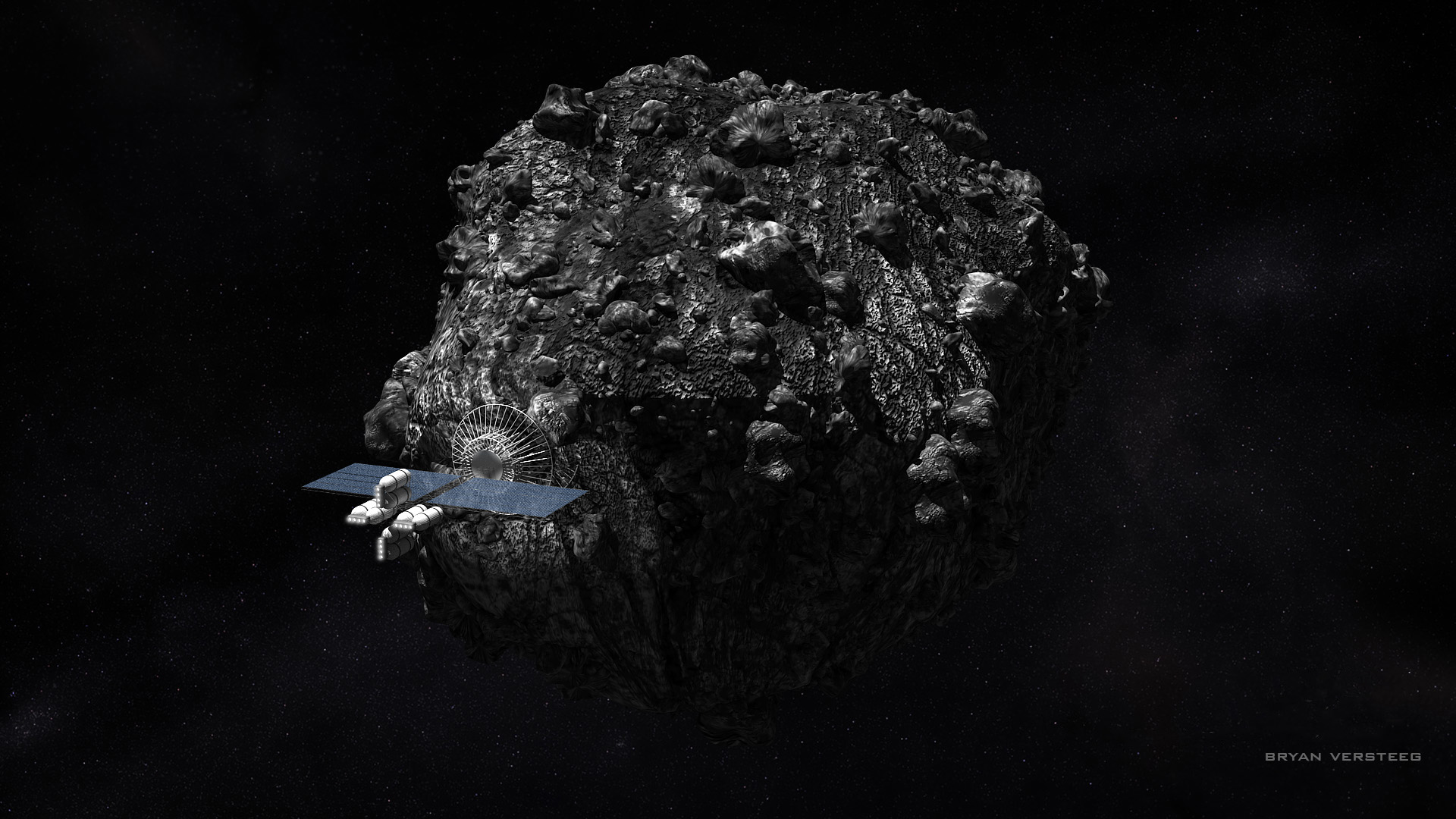

This is the context within which we raise broad general discussion of space resources. You guys can see how we can answer each of the above strategic conundrums..

You know my beliefs regarding Moon versus asteroids. They are irrelevant for the purposes of this general discussion, and only need to get addressed ‘down the track’ in later conversations.

In any case, ‘Moon for Moon, Mars for Mars, asteroids for deep space’.