Terrestrial Mining Stories

Terrestrial Project Concept Development Stories

I have seen, ‘up close and personal’, the economic and concept definition stories in multiple mining projects: Mary Kathleen, Jabiluka, Olympic Dam, Nolans Bore, Mulga Rock, Jacinth-Ambrosia, Mt Keith Nickel, the Kambalda-Kalgoorlie-Kwinana nickel industry, the Browns Range HREE project, and have ‘industry cultural heritage’ exposure to others: the Darling Scarp bauxite deposits, Mt Isa Mines, the Sydney Basin Coal Measures (where I grew up), the Bulolo Gold Dredging story in PNG, and others.

Mary Kathleen Uranium:

First operation (1958-63, produced 4,000 tons of yellowcake) basically launched Rio Tinto as a credible organization. It was at that stage one of the biggest U mines in the world..

Long and very painful rebirth for second operation (1976-82, 4,300 t U3O8). Why painful? Because the grade was a lot less: because of worse waste-to-ore ratio, they went to bigger equipment and therefore less selective mining method, and the drop in grade was worse than expected. And the upgrade via radiometric sorters only ‘sorta’ worked. Result: they had headgrade to mill of 0.08% when they had expected headgrade to mill more like 0.12%. (Ouch..) To make budget, they had to squeeze >50% more tonnes thru the mill, which was not up to it, and thus kept failing…

Learnings: Grade is crucial. So is adequately conservative mine and project planning.

Jabiluka:

Briefly touted as the world’s biggest uranium deposit (never went ahead, due to govt and then Traditional Owner resistance). Engineering demands (water balance in the wet tropics) prompted the transition from open pit design to (totally different–) underground design. This gave massive reduction in rainfall footprint, massive reduction in waste rock dumps footprint, hence massive reduction in environmental cost and risk, and gave big, big reduction in capex and opex (positives), but inserted into the equation other risks (rockfalls underground, and radon in underground U mines), which was where I came in.

Learnings: Sometimes the environmental /risks review throws up a showstopper; in which case, you have to go back to the project concept to see if there is another way to do it.

Olympic Dam:

Olympic Dam in central South Australia is a massive copper-uranium-gold-silver orebody in a haematitic breccia also loaded up with rare earths. ‘It is the biggest uranium deposit in the world, and one of the ten biggest copper deposits.’

When it was discovered in the mid 1970s (the orebody is at 400 metres depth) one of the first questions the proponents wondered about was whether it was amenable to open pit mining versus underground. Back-of-the-envelope estimates showed however that it would cost $2 billion in ‘dollars of the day’ to ‘skylight’ the ore, thus making open pit impractical economically.

This presented a political and technical challenge, as the perception had arisen that all underground mining of uranium ores was in principle unmanageably dangerous. (Reasonable, given that lung cancer rates in the 1950-1960s Utah-Colorado U miners had been 20 x normal.)

This perception had to be checked against reality in the case of modern, well-engineered and (critically) well-ventilated underground operations; and, then rigorously, pedantically, and technically, put to bed. In the process, we had to choose specific underground mining methods which would allow for adequate ventilation and adequately safe air quality re radon decay progeny concentrations. Some mining methods would have delivered poor and indeed over time, ‘showstopper’ conditions. (all of that was my specific job…)

As to the means of extracting the value, we did not know at first (and it only slowly became obvious) what process flowsheet we would use. The front end would be crush, grind, float to produce a copper sulphide concentrate; that was pretty obvious. The flotation ‘rejects’ carried the bulk of the U which would go to a normal acid leach, solvent extraction, ammonia precipitation, calciner process to make ‘yellowcake’. But then, what to do with the copper concentrate? The choices were roast -atmospheric leach – electrowin, or pressure leach – electrowin, or smelter then electrolytic refinery. The choice was to go the smelter route. All these processes were predicated on producing final processed ‘four nines’ (99.99% pure) cathode copper product on site, so as to categorically avoid any concern with shipping ‘radioactive’ copper concentrate.

So, proposal was for what would be the biggest underground mine in the country, mining (eek!) uranium, and a huge treatment plant complex to produce yellowcake, cathode copper, gold, and silver (that used to take me two hours to walk end to end).

(desert looking a bit greener than normal in this piccie..)

The go-ahead was thus a very ballsy decision, even tho’ much of the technical risk was retired by pre-commercial underground expln development (20 km of drives, over 5 years, ca $50M!) and by a $20M,100-man, 2-yr-campaign, large-scale pilot plant..

Learnings: a Trial Mine and Demo / Pilot Plant can be very useful to retire technical risk.

The pre-production trial mine was developed via a fullscale shaft-sink, with fullscale underground development. The decision to go to shaftsink was taken at a time when the WMC Board still knew very little about the mineralization (except that it was very big). The BP Joint Venturers were tightwad and argumentative and firmly against the decision to go fullscale in u/g development. I was in the room watching the argument develop. The old BP/Seltrust mining guru was arguing (for cost reasons) for small-scale tunnels to get out to the laterally distributed target areas where we were to do underground expln drilling. The young, WMC project mining engineer, Bob Crew, pushed back with the argument ‘you need full-size equipment to get rapid development, you want to get out to the target areas fast, use proper mining gear; and then when the go-ahead for fullscale mining is given we don’t have to go back and waste time stripping out to get bigger size tunnels.’ He won.

Another learning: there are circumstances where it makes sense to go straight to production-scale equipment so you can seamlessly transition into production when ‘the time comes’..

(note: this also applies in the oil industry: wildcat wells are drilled using fullscale equipment, so that if they do produce payable flows then they can be hooked straight into the downstream collection system..)

Another ‘learning’: Sometimes, even going into the Final Feasibility Stages, you still haven’t been able to eliminate enough options. We had, as presented in the EIS, three different underground mining concepts (with different costs and constraints), and three different process flowsheet options. Sometimes you have to say: ‘we still don’t have enough data, but we know that we can make money on any of them, so we should proceed anyway..’

Nifty Copper Mine:

Little baby project to build an open pit copper mine with heap leach and Cu EW (electrowin) circuit something like 300 km east of Marble Bar in the Great Sandy Desert, 1500 km NNE of Perth (i.e, just about the most remote spot in Australia – it was really bizarre to fly for 3 hours into the desert to find there a small neat electrolytic copper production facility. As a not-really aside, the extreme remoteness was what necessitated going all the way to electrolytic cathode copper as the final product, because trucked-out concentrate would have been such a cost burden as to be a project killer.

I watched the Project Manager repeatedly re-sharpen his pencil on this little dog of a project. Too remote, not enough ore… Well, against all good judgement, the WMC board gave it the green light, it struggled into existence, they found more ore, went underground (jeez, higher costs there!) and to my amazement, it is still running, under new owners, 30 yrs later, and apparently making decent money (finding more ore, and at adequate grade, forgives lots of problems; and writing off sunk costs allow significant gains from incremental expenditures..)

Beverley Uranium:

The Beverley Project is privately owned by Heathgate Resources, itself owned by General Atomics, of Project Orion, atom bomb-powered battle-cruiser to Saturn fame…

The Beverley Project, central-eastern South Australia, is based on orebodies which reside in sand-filled palaeochannels buried at about 100 metres depth and confined by overlying (and underlying) siltstones and clays.

(Named after the wife of the original owner, Bill Siller, an entrepreneur whose mineral explorationist ‘stable’ included Exoil, Transoil, and Petromin. He had been looking for uranium in the Flinders Ranges, near the old 1930’s radium workings of Mt Painter and Radium Creek, but on prompting by his geochemist, then went looking for redeposition deposits in buried palaeochannels under the rounoff plains to the east. Wildcat drillhole number 3 or 4 hit the Beverley deposit.)

The initial mine plan (developed by then-Joint Venturer Western Nuclear, 1980) had been to open-pit the deposit. This project did not proceed for political reasons.

The project was sold in 1997, for a pittance, after Bill became fed-up with the political wrangles and delays. General Atomics decided to use the developing technology of in-situ leach, where you drill an array of boreholes, extract groundwater, add acid or alkali and oxygen, re-inject down injection wells, dissolve the uranium, and suck up through recovery wells the ‘pregnant lixiviant’ (U-loaded groundwater) which you then extract the uranium out of via solvent extraction or ion exchange.

This was to be the first acid-leach In-Situ Leach U project in Oz, thus a bit of a political adventure. The pilot plant that GA built (and that I worked on) had the U ‘just jumping out of the ground’ into our ion exchange columns! They ran the single 5-spot pattern for a year and it was still giving 50 or 60 ppm U in loaded groundwater after 11 months! We could have turned the ($5M) pilot plant into a very very lucrative commercial operation if we had had a legal pathway to get the requisite approvals.

Learning: Sometimes the Minimum Viable (commerical) Project might be very small (and very easily implemented) with very low Capex and Opex.

Arafura's Nolans Bore REE Project:

Nolans Bore is 140 km north of Alice Springs, Central Australia: Marvellous outcropping easy to mine orebody. Unfortunately, like many other REE ore, the material requires, for adequate recovery, very aggressive leaching. The project team assessed in turn, nitric, hydrochloric, and finally conc. sulphuric acid leaching (acid bake at 250 C). They at the same time, locked themselves into a complex flowsheet that sought to recover significant value from the associated phosphate, but then that rationale went away, but only after spending (wasting) $50 million on pilot testing… As a result they lost investor confidence big-time…even tho’ they gained a good handle on their process, including not just the difficult front end leaching but also the extremely painstaking differential SX separations of the 4 or 5 final RE products.

So, many millions of dollars of pilot work was wasted on metallurgical dead-ends (phosphate purification, too hasty upscales from what should have been bench tests to big hairy-chested demo plants). Projected Capex >>$1B, high opex, forced major process rethink. Downscope and major project definition change halved Capex and Opex. Some really nice work came together to allow this, involving finding new, large groundwater resources close by. This enabled relocation of the separation plant from a remote site about 1600 km away, only supportable at very large scale, to a minesite location, and downsizing.

Learnings: be very cautious before you finalise your process flowsheet, and limit your spend on testwork until you are truly on a process optimization, not a process choice, track…

Another learning of this story is that the ancillary support constraints (in this case, previously inadequate local water supply) can if overcome open up a totally new way forward.

Another learning: note that one of your intended products may end up being the ‘tail wagging the dog’, and may end up costing in complexity and cost far out of proportion to the revenue it can return.

And, be aware you may be able to ‘hand off’ some significant risk if you are willing to accept a lower return on sale of intermediate rather than final products.

Vimy Resources Mulga Rock Project:

Remote, 300 km east of Kalgoorlie in WA, this is a bizarre orebody (orebodies) containing colloidal U, Ag, Au, Sc, Ni, Co, Pb, Cu, Zn, and REEs, in an unconsolidated oily lignite (!!!), at, unfortunately, 40 metres depth… and more recently discovered, under one of the orebodies at least, another 100 metres down, a U orebody comprising uraninite in unconsolidated sands, initially thought amenable to ISL. Even more recently, tho, the answer has been ‘no, the sands are too discontinuous’.

Question one: how do you mine these orebodies so that activity on one horizon does not ‘sterilize’ future work on t’other?

Question two: how the hell do you process this stuff, and /or what do you choose not to worry about? What’s the ‘driver’ product? Very very easy to get distracted. Was it uranium? Or scandium? Or the base metals? Answer may change with project size, and over time, and certainly with differential market movements for the various potential products. How to retain flexibility?

These questions caused significant pain, and there were, over several years, several very significant project scope and design changes before the final mining plan and process flowsheet were arrived at. It took a long time, even tho’ these were very smart people.

There was some nice work done off the back of revisited mining plans on how to rehabilitate as you go.

Lesson: Need to ‘keep it simple’ especially for startup. Keep Capex as low as possible. Figure out how to transition to bigger scale and more complex output.

Another lesson: you may need to iterate through your project concept several times before it becomes clear just what the simplest, lowest risk and lowest capex solution is.

Iluka's Jacinth-Ambrosia Mineral Sands Project:

I was on the Project team, as their external radiation and OHS consultant. After many months of slow painful project description and engineering development, weekly telecons, and approaching ‘closure’, with ramping up of detailed engineering design and costing, the Chief Geo came on line one meeting and said ‘Umm, we know this is a bit late, but umm, we’ve found some more ore, well, quite a lot, actually, at depth, and the increased prices of zircon et al, and the gradational nature of our ore, umm… it changes the scope, er, quite a bit..’ The Project Manager quietly but icily replied, ‘That’s very good news, Brent; but do you realise we now have to throw out the last 4 months of very expensive pit engineering by our team of 6 contract engineers.. You’ve just burned about $250,000, pity you couldn’t have warned us earlier’ It was Good News, but we had to go back to Clean Sheet.. J-A ended up being a very good project.

Learnings: Scope changes late in the planning cost a lot, but still not as much as scope changes after you are running.

Mt Keith Nickel:

I was WMC’s corporate Health and Safety Manager when WMC purchased this prospect. I immersed myself in the various reports and did a double-take about half-a-day into my reading when I found that the (ultramafic) nickel sulphide orebody looked like it might be riddled with contaminant chrysotile (white) asbestos.

‘Jeez guys, did you even read this?’ ‘Ah yeah, didn’t think it would be a prob.’ ‘Well, boyo, it will be. You better have superlative dust control at all stages of mining and processing…’

When the Met Plant was about to be commissioned, I repeated my warning to the Commissioning Manager to ensure all dust suppression sprays and collection hoods ‘gotta be working from the start’. Well, they started CV1 conveyor, feeding coarse crushed ore to the primary stockpile for the first time, one night shift, without the water sprays going. When everybody arrived at work next morning, the stockpile area, and the surrounding 100 metres, all looked like a Rudolph the Red-nosed Reindeer Christmas card! Within an hour, 800 extremely pissed construction workers were on strike, demanding to be flown home (and reasonably so, actually…).

I got flown in, with a Senior Inspector of Mines, to talk with the company about What To Do, and with the troops to try to get them back to work (construction downtime was $1M/day).

Learnings: assemble your Risk Register early, and keep reviewing it..

Greenland Energy & Minerals’ Kvanefjeld deposit in southern Greenland:

This is a low grade but very large outcropping REE-U-Zn orebody. What is the project concept to be? It is obvious that it will be a large open pit. But will they try to run it through winter season, or only run in the summer season, when there is daylight?? (and less snow). How will they handle the tailings? Disposal into a constructed dam, or into a local lake, or to seabed (Deep Sea Tailings Disposal)? Each has pros and cons, and different ‘optics’.. The choice will impact on where they locate the treatment plant (and thus its cost). Then there is the metallurgy…

Learning: Extremely important to spend time thinking through the project scope and philosophy.

Here’s couple more stories from Aussie mining history:

Central Norseman Gold:

A worked-out gold mine that WMC bought, and via careful geological reinterpretations, found a bit more ore, and then a bit more, and then a bit more.. But for its entire life, now well over 50 yrs, it has never had more than about 2 yrs of mine reserve left!! The geos were forever ‘under the pump’ to Find More Ore. It’s emblem was the Phoenix, fittingly..

As an aside, the main economic metric used by Sir Arvi Parbo (‘I’m just a simple goldminer’) as Chairman of WMC was: Payback Period. He *understood* NPV, but he *worried primarily* about Payback Period.)

Learnings: focus on good science, continued review of interpretation, and persistence. (See the Roy Woodall James-Joubert Lecture on the internet for more on this story..)

Bulolo Gold Dredging and Airlift:

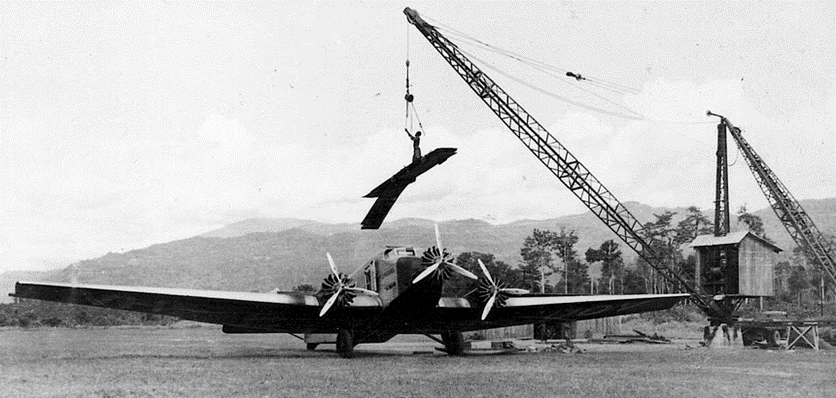

Unloading a Junkers at Bulolo in the New Guinea highlands sometime in the 1930s

Here’s a precis of the fascinating story of the development of the New Guinea Morobe Goldfields.

Gold was discovered at Koranga Creek near present-day Bulolo, pre WW1, in 1912, by an ex-Klondike prospector named ‘Sharkeye’ Park, who illegally entered then-German New Guinea from the Australian colony of Papua by trekking in over the Owen Stanley Ranges on what later became known as the Bulldog Track. (3 weeks walk in..)

Park later re-entered the field after WW1 from Salamaua on the north coast, trekking in over what later became known as the Black Cat Trail (2 weeks walk in..), and recommenced illegal mining as there was no mining ordinance in place in the now-Australian-administered League of Nations Protectorate of New Guinea.

Sprung by the cops! Patrol Officer Cecil Levien tracked him down, at his remote sluicing operation, and gave Park an ultimatum: ‘You’re illegal; I could shut you down and confiscate your winnings… but, hey, I see the possibilities… I recommend you set up a company, with me as one of your directors, and I’ll volunteer to go back to Rabaul and get the Administration to set up a Mining Code, and help get your paperwork in order…’ (gross oversimplification, this, but the flavour is right..)

But how to set up an industrial-scale mining operation in a remote mountainous jungle where the local tribesmen just want to kill you? Neither roads nor rail were a possibility. But airplanes were..

Ultimately, under Levien’s guidance, and with investment from a small Canadian outfit named Placer Development, there were constructed during the 1930’s, 3 townships, 8 dredges ranging in mass from 1200 tonnes to 1800 tonnes, and two hydroelectric plants to power it all, all flown in in bits in three Junkers G31 trimotors, and reassembled onsite. The total population, of about 4,500 (about 3,500 locals (native workers) and about 1000 expatriates (whites)) was -apart from self-grown local food and diary- totally supported by airlift. The first roads went in only after WW2.

The 4 busiest airports in the world in the 1930s were Lae and Salamaua on the north coast of New Guinea, and Wau and Bulolo in the goldfields. More airfreight was moved in 1931 than the entirety of all airfreight in Canada, US, UK, and France. (ref, ‘Not a Poor Man’s Field’, Michael Waterhouse, Halstead Press.)

Loading a rod mill thru’ the roof hatch

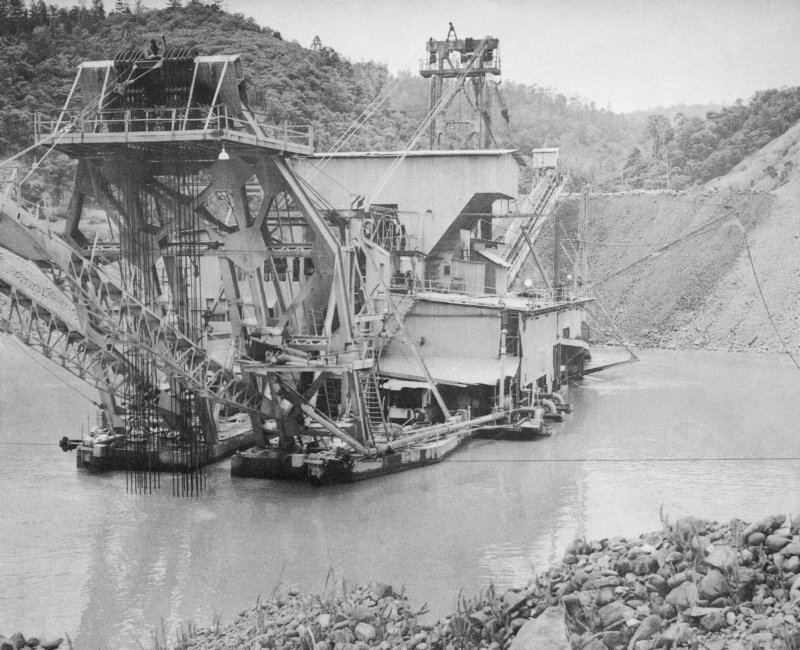

And here’s what it was all for: one of the eight gold dredges, 1200 tonnes to 1800 tonnes.

(I visited Wau and Bulolo in the early 1970s, and clambered over one of these

derelict dredges, with my then-girlfriend Robyn and my mate ‘Dr Karl’, and they

were bloody big..)

Now, might the modern version of this ‘mining in really remote places’, be accessing space resources using SpaceX Starships instead of Junkers G31 trimotors??

Learnings: ’Impossible’ logistics can be overcome if the ore is valuable enough. Dare to think out-of-the-box.

There are repeating themes here, applicable to Space Mining:

Define your orebody accurately; note this is market-dependent

Check you have correctly identified your main product

- Mining options may be unclear.

- Metallurgy is a big issue: Processing options may not be obvious.

- Minimize Capex.

- Beware Opex.

- Seek fast payback.

Not obvious how best to monetize your asset.

Getting the overall concept and constraints right first, is important.

Sometimes major, major rethinks are required.Need to listen to unwelcome messengers

Sometimes people walk away from good projects (if only they knew..)

Sometimes a project comes good and just keeps on giving.

Only freeze project design after you have thoroughly tested it against reality, and against alternatives…